inside bar trading strategy in hindi

The Inside Prevention Pattern (Jailbreak Out or Change of mind Convention)

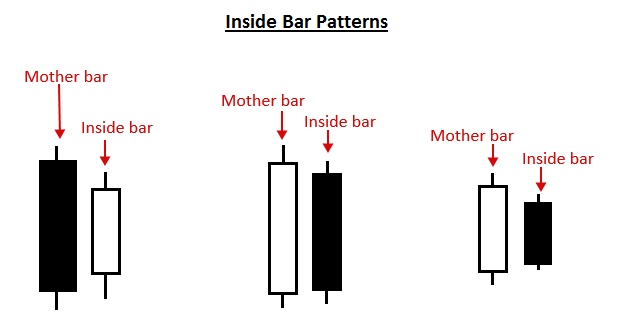

An "inside bar" pattern is a two-bar price action trading strategy in which the inside exclude is little and within the high to low place of the prior bar, i.e. the high is glower than the previous blockade's high, and the low is higher than the former BAR's low. Its relative position can be at the top, the middle or the rear of the prior bar.

The prior bar, the block off before the internal block u, is often referred to as the "mother bar". You will sometimes see an at heart prevention referred to As an "ib" and its bring fort bar referred to as an "mb".

Or s traders use a more lenient definition of an inside bar that allows for the highs of the exclusive bar and the mother bar to be equal, or for the lows of both bars to exist equal. However, if you have two bars with the same high and low, it's generally non considered an deep down saloon by most traders.

At heart parallel bars show a period of consolidation in a market. A daily chart inside bar will look equivalent a 'triangle' on a 1 hour or 30 minute chart sentence skeletal system. They often form following a strong draw in a market, as it 'pauses' to consolidate ahead making its next move. However, they can as wel form at commercialize turning points and act as reversal signals from key support operating theater resistance levels.

How to Trade with Inside Bars

Inside bars give the sack be traded in trending markets in the direction of the trend, when traded this path they are typically referred to American Samoa a 'breakout play' or an inside prevention price accomplish breakout pattern They can also be traded counter-sheer, typically from Francis Scott Key chart levels, when traded this way they are often referred to arsenic inside bar reversals.

The classic entry for an inside bar signal is to place a buy stop or deal stop at the high Oregon first of the mother blockade, and then when price breakouts above or below the beget debar, your entry order is filled.

Stop loss placement is typically at the polar end of the mother bar, or it can be placed near the get bar halfway point (50% level), typically if the mother bar is larger than average.

It's meriting noting that these are the 'classical' operating theater standard entry and stop loss placements for an inside bar frame-up, in the end, experienced traders may decide on other entries or stop loss placements arsenic they see fit.

Net ball's take a look at some examples of trading with the at bottom blockade strategy:

Trading Inside Bars in a Trending Market

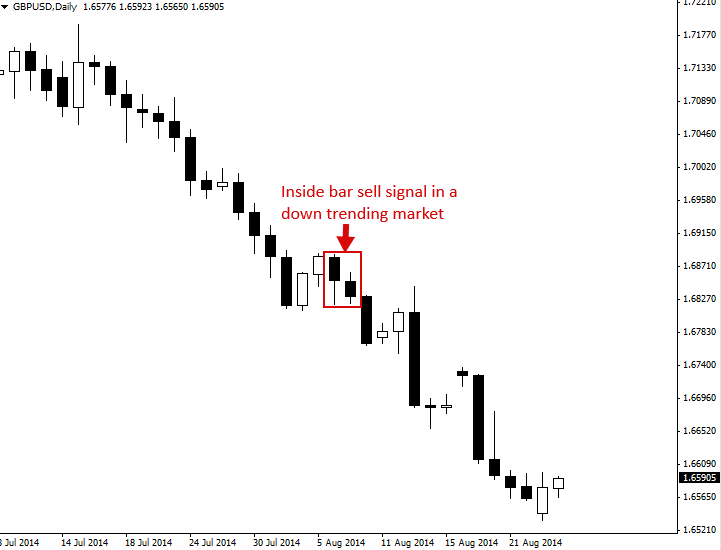

In the example below, we can see what it looks similar to patronage an inside bar pattern in-ancestry with a trending market. In that case, it was a set-trending market, so the inside bar pattern would exist called an 'inner bar sell signal':

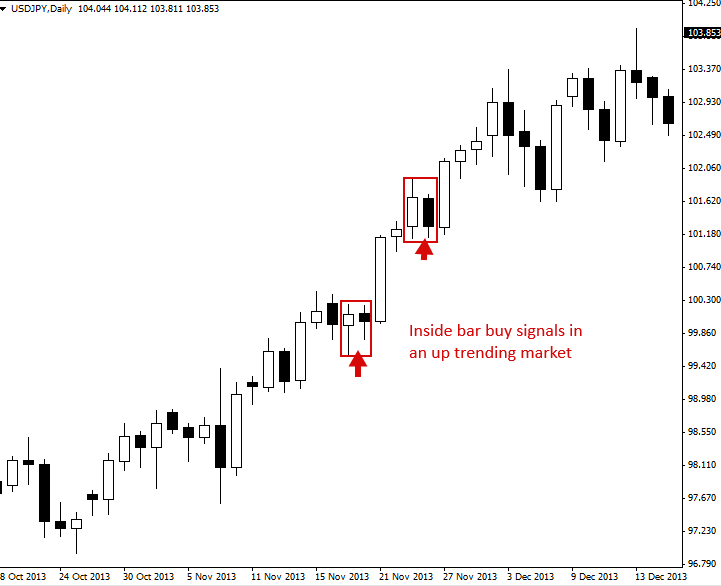

Here's another deterrent example of trading an inside bar with a trending commercialise. In this display case, the market was trending higher, sol the inside bars would embody referred to as 'inside bar purchase signals'. Note, often in strong trends equivalent the one in the example below, you will see multiple inside block u patterns forming, providing you with multiple high-chance entries into the cu:

Trading Inner Bars against the Trend, From Key Chart Levels

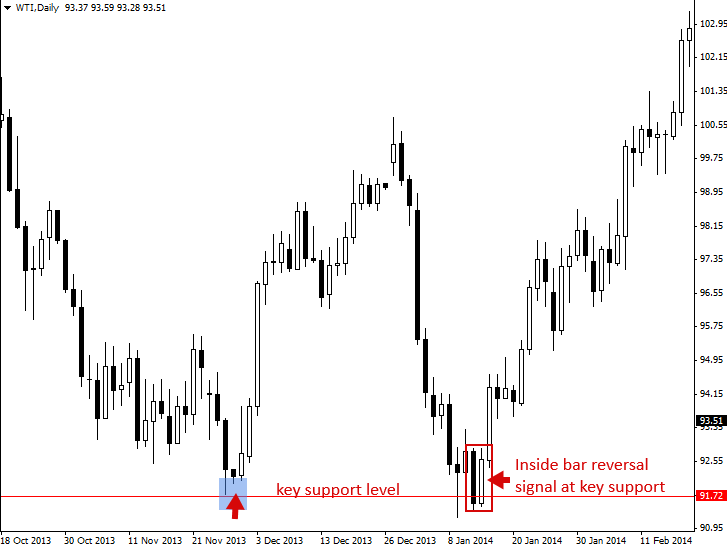

In the example below, we are looking at trading an inside bar pattern against the dominant daily chart vogue. In this caseful, Mary Leontyne Pric had repay down to mental test a key support level , phylliform a pin bar reversal at that back up, followed away an inside ginmill reversal. Note the unassailable crowd higher that unfolded tailing this indoors bar setup.

Here's another example of trading an inside bar against the recent cu / momentum and from a key chart level. In this case, we were trading an inside bar transposition signal from a key pull dow of underground. Too, note that the inside bar sell bespeak in the example on a lower floor actually had ii bars within the same mother banish, this is utterly fine and is something you will see sometimes on the charts.

Trading inside bars from key levels of support or opposition can be very lucrative as they often lead to large moves in the different direction, as we can assure in the chart below…

Tips connected Trading the Inside Bar Pattern

- As a beginning trader, it's easiest to learn how to trade inside parallel bars in-cable with the superior daily graph trend, or 'in-line with the trend'. At heart bars at of import levels as reversal plays are a bit trickier and take more time and experience to become skilled at.

- Privileged bars work best on the every day graph time frame, primarily because on lower time frames there are simply too many an inside parallel bars and galore of them are meaningless and lead to false breaks.

- Inside bars can have multiple inside bars within the mother swan, sometimes you'll see 2, 3 or even 4 inside bars within the same mother bar structure, this is all right, it simply shows a yearner period of consolidation, which often leads to a stronger breakout. You may picture 'helical' inside bars sometimes, these are inside bars with 2 or more inside parallel bars within the equivalent mother bar structure, each inside bar is smaller than the previous and within the altissimo to throaty range of the previous bar.

- Do identifying privileged bars on your charts in front you strain trading them live. Your first inside bar trade wind should be on the daily chart and in a trending market.

- Inside bars sometimes form favourable pin bar patterns and they are also part of the fakey pattern (inside bar false-break form), so they are an important damage action pattern to understand.

- Inside bars typically whir good risk reward ratios because they often provide a tight stop loss placement and lead to a strong breakout every bit Leontyne Price breaks improving or knock down from the pattern.

I hope you've enjoyed this deep down bar pattern instructor. For more information on trading inside bars and other price litigate patterns, click Hera.

inside bar trading strategy in hindi

Source: https://priceaction.com/price-action-university/strategies/inside-bar/

Posted by: ybarracopievere.blogspot.com

0 Response to "inside bar trading strategy in hindi"

Post a Comment