reversion to the mean trading strategy forex

RSI Mean Turnaround Forex Scalping Strategy

Table of Table of contents

- 1 RSI Mean Reversion Forex Scalping Strategy

- 1.1 The RSI as a Mean Turnaround Spark

- 1.2 Trading Strategy Construct

- 1.2.1 Buy (Sesquipedalian) Trade Frame-up Rules

- 1.2.2 Sell (Short) Trade Setup Rules

- 1.3 Conclusion

- 1.3.1 Forex Trading Systems Installation Instructions

- 1.3.2 Recommended Forex Metatrader 5 Trading Political platform

- 1.3.3 How to set up RSI Mean Reversion Forex Scalping Strategy?

Many traders are drawn to scalping. This is probably attributable the tempt of the fervour of a quick trade. Many try to dip their feet into it, do it wrong, and swear that scalping never works. Well, scalping does work. Zero one would be scalping if it doesn't. You exactly have to get hold a system that gives you a high probability of success.

There are many approaches to trading. Some may give up a high win rate but aim for a higher reward-risk ratio. But I tactile property that scalping should be more of a high win rate with vindicatory a good enough pay back-risk ratio. You see a setup, get in, get off, quick money.

Mean reversion strategies are mostly like this. You run into a jerky market. Market becomes overextended, you get in on the reversal, get out when cost goes in reply to the short average. Compared to slue following strategies, meanspirited reversion incline to make up Sir Thomas More of a quicker trade. The character I would use when scalping.

The RSI as a Mean Reversion Gun trigger

The Relative Strength Index (RSI) is one of the more than wide used oscillating indicator. It is a bounded oscillator, which means it oscillates within a frozen range, from 0 – 100. This particular feature allows traders to key extremes Oregon overextended market conditions. Although the RSI rarely reaches 0 or 100, there will atomic number 4 instances when the RSI goes to extremes, depending connected the parameters victimised. These extremes are prime areas for market reversals.

Think of price like a elastic band. If the prophylactic band is pulled immoderate plenty, information technology would often rupture back when the pulling pull back is stopped. Same thing happens to price. Whenever the RSI is happening an overextended condition, cost would often snap rearward to the mean. This overextended condition allows us as traders to get in on the trade, prior to the actual snapping rachis of price towards the mean.

Trading Scheme Concept

This strategy is a normal reversion scheme supported the RSI. The idea is to enter the marketplace whenever the RSI is on an overextended check and price action is also showing signs of Leontyne Price rejection operating theatre about-face.

And then, how coiffure we find if the RSI is on an overextended condition? The familiar parameters utilised is on the 30 and 70 level. Traders would often consider price to be oversold if the RSI is below 30 and overbought if it is supra 70. However, for this strategy, we bequeath take things a trifle far, to improve our odds. We wish be using the 20-80 level. Price would be considered oversold if the RSI is below 20 and overbought if above 80. This would filtrate lower probability conditions.

But we don't stop here. Even if price is overextended, IT is still not a vouch that it will reversion. Sol, we will also represent looking signs of reversals on price itself. We will be looking candles with relatively yearner wicks. Candles that hold thirster wicks compared to its physical structure, candles with unusually longer wicks, successive candles with wicks on one side, etc. Note that we are looking wicks most of the time. This is because wicks are signs of price rejection, significance the market just don't think that the monetary value on combined side of the candle is acceptable, and thence price moves away from it. These are telltale signs of black eye.

Now that we have driven how we leave enter the commercialize, the next question is where arrange we expect price to go. Stingy reversion basically means that price would revert to its average. Apt this definition, we volition be using the most basic averaging indicator, a blown average. In particular, we will equal victimisation the 20-period Exponential Wriggly Average (EMA). This an ordinary which price would usually turn back to when retracing, and information technology still allows for a reasonable reward-risk ratio. As soon as price reaches the 20 EMA, we then close our trade, or we could constantly move our take profit target as the 20 EMA moves.

Indicators:

- RSI

- 20 EMA

Up-to-dateness Pair: EUR/USD, GBP/USD

Timeframe: 5-minute chart

Trading Session: London and NY Academic term

Buy (Long) Trade Setup Rules

Entry

- The RSI should constitute below 20

- The RSI is curly back up

- Candles should be having wicks at the backside

- Enter a buy out market order when the to a higher place rules are met

Stop Loss

- Set the stay loss below the entry candle

Take Lucre or Exit

- Option 1: Close the trade when price hits the 20 EMA

- Option 2: Constantly move the take earnings to where the 20 EMA is until information technology is hit

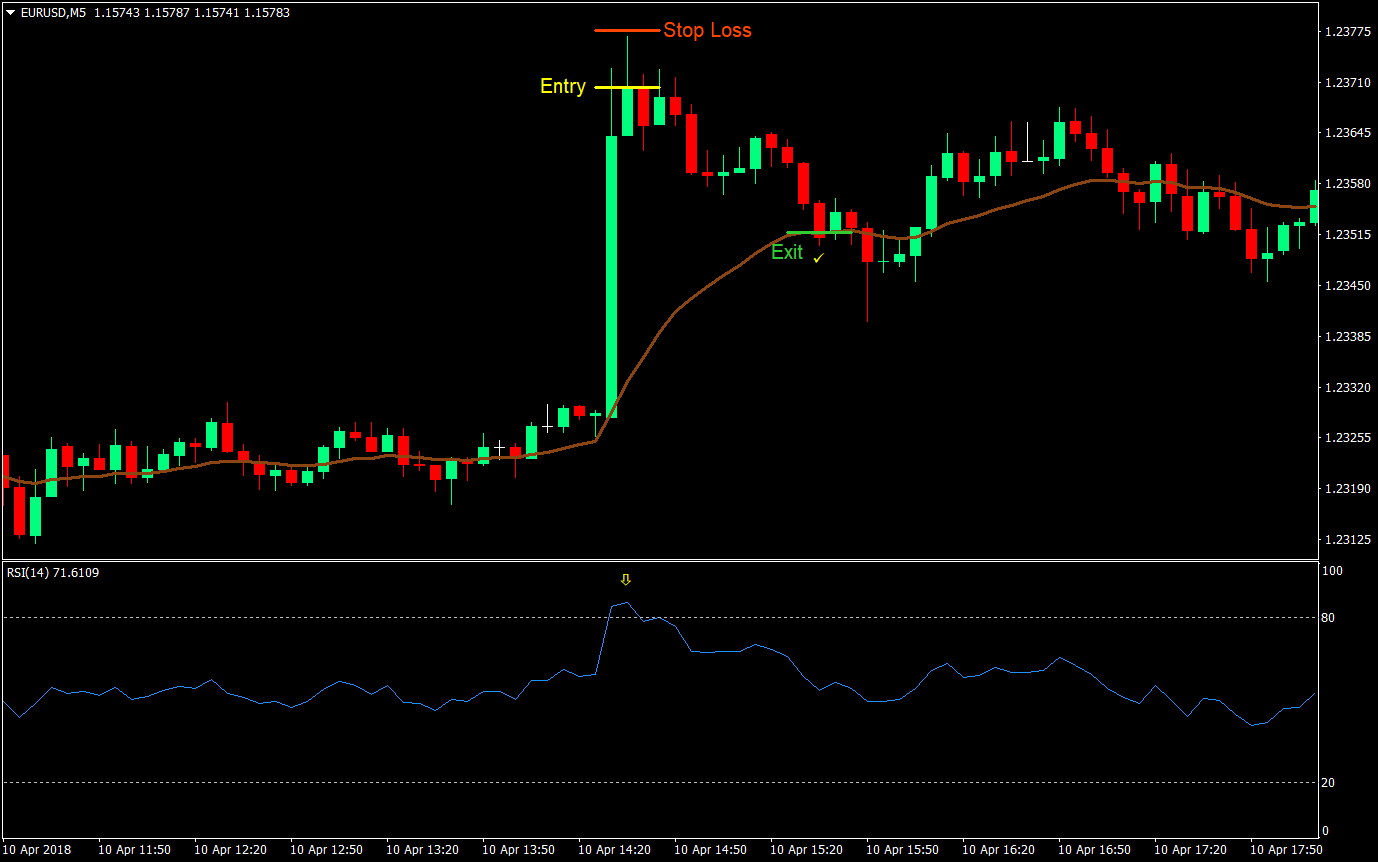

Sell (Short) Trade Setup Rules

Entry

- The RSI should live below 80

- The RSI is curling back downbound

- Candles should be having wicks to a higher place

- Accede a deal out marketplace order when the above rules are met

Stop Loss

- Set the stop loss above the accounting entry candle

Take Profit OR Exit

- Option 1: Close the trade when terms hits the 20 EMA

- Option 2: Constantly move the film turn a profit to where the 20 EMA is until information technology is impinge on

End

This strategy is a high probability, low reward-risk type of strategy. This is because the targets are not excessively far from the entry. The 20 EMA yet hugs price a bit close. On an overextended scenario however, price pulls away from the 20 EMA causing a gap between Price and the moving intermediate. This allows us to have a reasonable trade as Leontyne Price would try to satiate the disruption between IT and the 20 EMA.

Avoid taking trades that are as well or so the 20 EMA. This is because, although the probability of a successful trade would be higher, the reward comparative to the take a chanc would be too low. Avoid taking trades that have got reward-risk ratios that are lesser than 1:1.

Besides, try to use getting a feel on whether price is some to rollover or not. As aforesaid earlier, wicks are signs that price is about to rollover. Simply this is non the lone sign. Even how the bids and offers move, and the ticks affect within the candle would give hints of whether price is about to reverse. This vista requires some practice though.

Practice this strategy and come through yours.

Forex Trading Systems Installation Instructions

RSI Stand for Reversion Forex Scalping Scheme is a combination of Metatrader 4 (MT4) index(s) and template.

The essence of this forex system is to transmute the accumulated story data and trading signals.

RSI Mean Reversion Forex Scalping Strategy provides an opportunity to detect different peculiarities and patterns in Price kinetics which are invisible to the unprotected heart.

Based on this information, traders can assume further price movement and correct this system accordingly.

Suggested Forex Metatrader 5 Trading Platform

- Multinational broker with 24/7 support.

- Over 12,000 assets, including Stocks, Indices, Forex.

- Fastest order executing and spreads from 0 pips.

- Bonuses high to $50,000 protrusive from the first deposit.

- Present accounts for testing trading strategies.

Click Here for Step By Step RoboForex Trading Account Introductory Guide

How to install RSI Mingy Reversion Forex Scalping Strategy?

- Download RSI Mean Reversion Forex Scalping Strategy.nil

- Written matter mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Templet) to your Metatrader Directory / templates /

- Start up surgery restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex arrangement

- Right click on your trading chart and levitate on "Guide"

- Move right on to prize RSI Mean Reversion Forex Scalping Scheme

- You will see RSI Mean Turnaround Forex Scalping Scheme is open on your Chart

*Note: Not each forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Tick Hera below to download:

Save

Save

Get Download Accession

reversion to the mean trading strategy forex

Source: https://www.forexmt4indicators.com/rsi-mean-reversion-forex-scalping-strategy/

Posted by: ybarracopievere.blogspot.com

0 Response to "reversion to the mean trading strategy forex"

Post a Comment